This afternoon the Federal Reserve Board released the November 2023 edition of its semi-annual supervision and regulation report. Consistent with past practice, the report has been issued in advance of scheduled testimony by Vice Chair for Supervision Michael Barr before the Senate and House next week.

In no particular order and with no particular claims as to significance, this post discusses things I thought were interesting based on a first reading of the report.

1. “Sound Overall”

Ever since the banking turmoil of earlier this year, it has become standard practice for the Federal Reserve Board to stress in official statements, as well as statements from Chair Powell and other individual governors and Reserve Bank presidents, that the U.S. banking system is “sound and resilient.”1 As particularly relevant to this context, “Sound and resilient, with strong capital and liquidity” was the framing used in the Board’s supervision and regulation report released in May 2023.

Today’s latest supervision and regulation report delivers a slightly more qualified assessment. The report notes that though the banking sector “remains sound overall,” “some banks have experienced sizeable declines in the fair value of some fixed-rate assets reflecting the increase in interest rates over the past two years.”

This framing is mostly consistent with the Board’s most recent financial stability report, released last month.2

2. Not Yet a Noticeable Change in LFI Supervisory Ratings

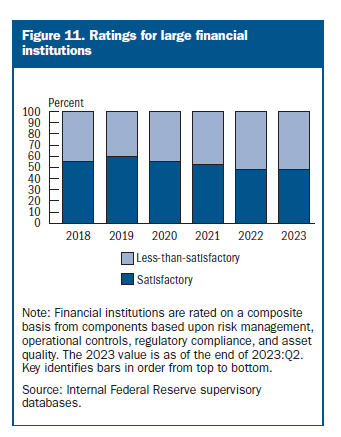

It has been the Board’s practice in its November supervision and regulation reports to provide aggregate data on the supervisory ratings of large financial institutions.3

Last November, the Board reported that “just under half” of LFIs had satisfactory supervisory ratings as of the first quarter of 2022. In this most recent report, the Board indicates that not much has changed — it says “only about half” of LFIs have satisfactory supervisory ratings, and provides the chart below.

The key caveat, however, is that these ratings are as of June 30, 2023. Given how exam cycles work, and given what the SVB situation earlier this year demonstrated about the time it can take for supervisory rating changes to work their way through internal processes at the Board and Reserve Banks, the supervisory ratings information in this report may not be an indication of future results.

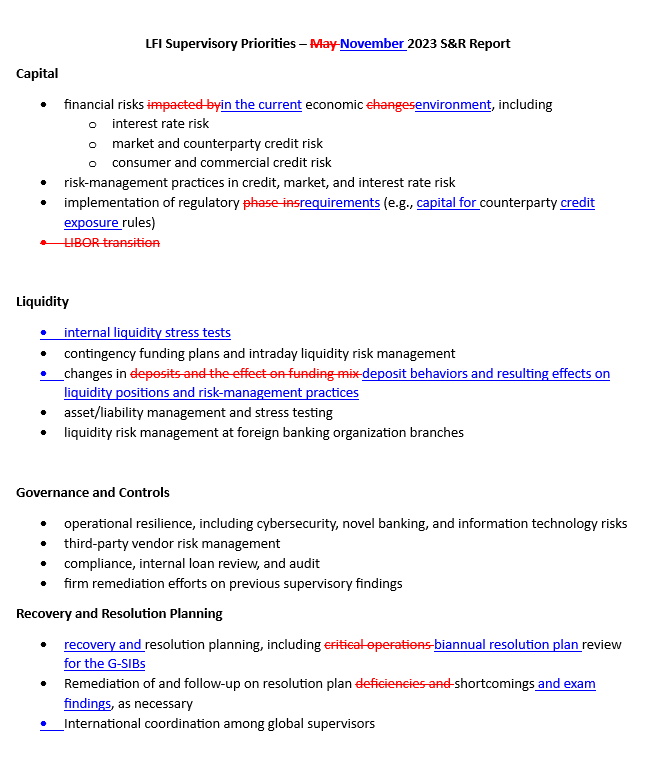

3. LFI Supervisory Priorities

The report identifies the Board’s LFI supervisory priorities for the coming months. The below redline compares these latest priorities to the LFI supervisory priorities laid out in the May 2023 iteration of this report.4

4. Other Areas of Supervisory Focus

Continuous Monitoring for Some

The Board states that its supervisors have “initiated continuous monitoring for a small number of firms with a risk profile that could result in funding pressures for the firm.” This is maybe not all that different from what was implied by a sentence in the May 2023 iteration of the report, which said that “recently, examiners have increased the frequency and depth of their monitoring of the funding positions of potentially vulnerable banks.”

Keeping an Eye on Lending to Shadow Banks

Separately, a bit later on in this same section of the report, the Board says that supervisors are also working to evaluate the “level and quality” of loans to nonbank financial institutions, “given a substantial increase in lending to this segment in recent years.”

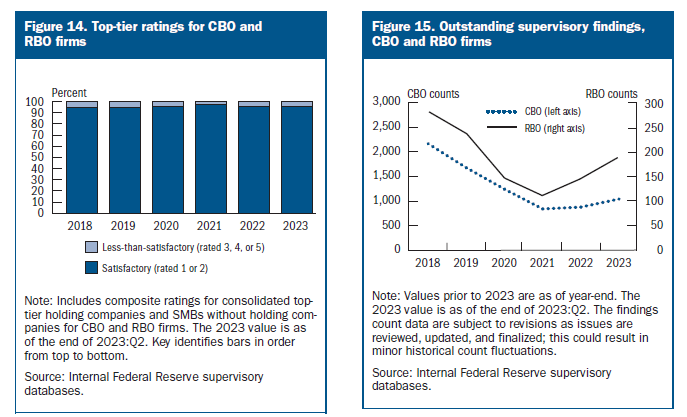

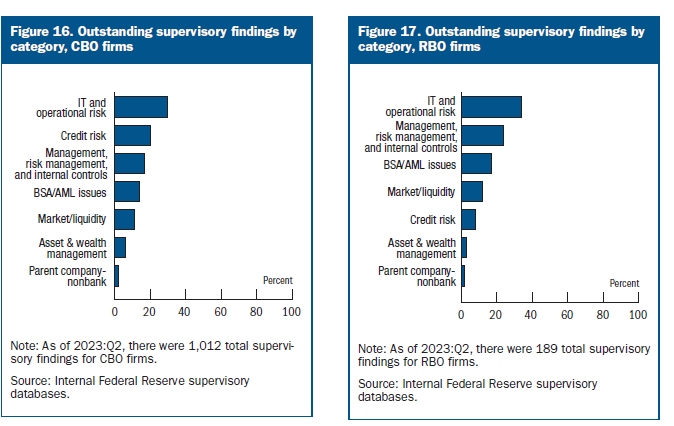

5. Are IT and Other Operational Risks the Biggest Problem Facing Community and Regional Banks?

Today’s report observes — again subject to the caveat that this data is of the end of Q2 2023 — that top-tier (i.e., in most cases, holding company) community bank and regional bank supervisory ratings are generally satisfactory. That said, supervisory findings have ticked up noticeably recently, even if they have not yet affected overall supervisory ratings.

More interesting, though, might be what the bulk of these outstanding supervisory findings are all about.

The report first observes that, in many cases over the course of 2023, “examiners issued findings requiring bank management to improve access to contingent funding, increase liquid asset buffers, and revalidate the deposit outflow assumptions in a bank’s contingency funding plans.” Community and regional banks are also being told to be sure they “understand the nature of their deposit concentrations and accurately assess the stability of each deposit segment.”

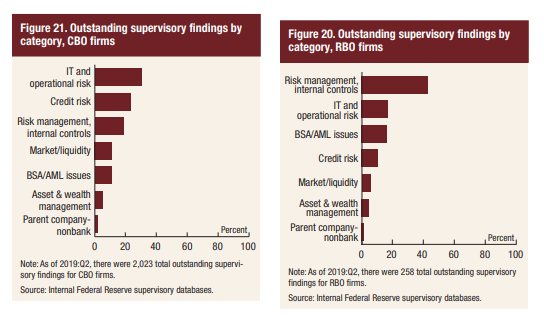

Nonetheless, outstanding supervisory findings for CBO and RBO firms are not concentrated in these core areas. Instead, IT and operational risk weaknesses make up the plurality of outstanding supervisory findings for both groups of firms.5

The supervision and regulation reports are inconsistent in the frequency with which they disclose this data. Looking through the archive of reports, I believe the last time the Board did this for CBO and RBO firms was in November 2019, as pictured below.

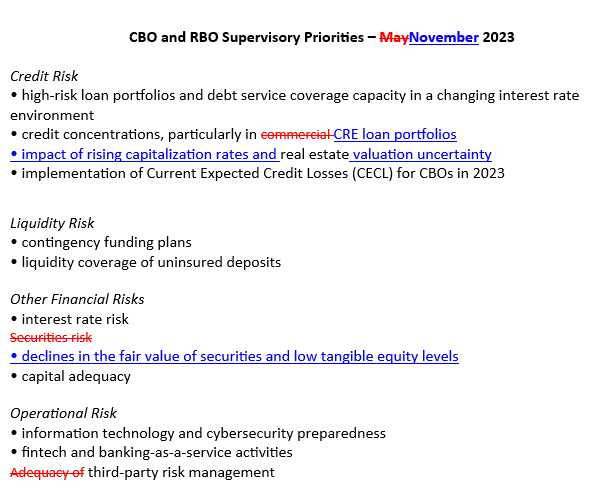

The current supervisory priorities for CBO and RBO firms, at least as bulleted out in the report, are not much changed since May 2023.6

6. No Updates on Certain Supervisory Initiatives

It was probably unrealistic to expect this report to be the means through which detailed updates on these matters would be shared, but there were a couple of things in the report that reminded me of work that Board officials or Board staff have previously said is in progress.

Improving the Speed, Force and Agility of Supervision

The report in the executive summary says the Federal Reserve is “taking steps to enhance the speed, force, and agility of its supervision” following the bank failures of earlier this year.

This paragraph goes on to give a few high-level examples of actions in progress (targeted reviews at banks exhibiting higher interest rate and liquidity risk profiles; outreach to banks and examiners on supervisory expectations for interest rate and liquidity risk management) and then says that the Federal Reserve is “committed to taking additional steps” to strengthen its supervisory approach.

This has been mentioned in previous posts on this blog, but back in June Vice Chair for Supervision Barr was reported in the American Banker as saying:

“Over the next six months, we're going to do a project that looks systemwide at the areas where we can enhance our supervisory culture, our practices, our behaviors, ours tools and also where we need to change our regulation of firms," Barr said at the event, which was hosted by the Federal Reserve Bank of New York. "We're extremely focused on that."

Six months from June would imply this will be wrapped up by the end of the year — maybe something for some enterprising Congressperson to ask about next week?

The RBO Portfolio

The Inspector General report into the failure of Silicon Valley Bank released in late September 2023 raised a number of issues relating to the Board’s supervision of firms in its regional banking organization (RBO) portfolio, defined for these purposes as firms with between $10 billion and $100 billion in assets.

Among other things, the IG recommended that the Board’s Division of Supervision and Regulation:

Assess the current RBO supervision framework and determine whether adjustments should be made based on a supervised institution’s size and complexity, such as unique or concentrated business models or rapid growth. […]

Assess whether the [Bank Exams Tailored to Risk] models are appropriate for RBOs, specifically those that are large or complex or that present unique risk factors such as concentrated business models or rapid growth, and determine whether a different approach to determining the scope and resources for examinations is needed.

Assess the current RBO supervisory planning process and implement measures to tailor supervisory plans to better promote a timely focus on salient risks.

A response from the Board’s Director of the Division of Supervision and Regulation, included at the end of the IG report, said that S&R concurs with all these recommendations and that the Federal Reserve is conducting “a comprehensive review of the RBO supervisory program.”

The response letter was clear that this and other projects relating to RBO supervision would not be completed until the end of 2024, so as noted above it was probably unrealistic and unfair to expect to see much addressing this topic in the November 2023 supervision and regulation report, even by way of interim update.

Again though, maybe a worthwhile area of questions for one of Vice Chair for Supervision Barr’s appearances next week.7

7. Rumors of State Regulator Discontent

Finally, this is cheating a little by moving away from the supervision and regulation report itself, but still very much on the topic of supervision and regulation was this speech from Governor Bowman today.

After recapping her objections to certain recent proposed rules, final rules, and guidance issuances, Governor Bowman turned to more general remarks about supervision and regulation.

Most interesting to me in this portion of the speech was this paragraph in which Governor Bowman reports that “a number of state banking regulators” believe that certain supervisory actions by federal banking regulators of late have been excessive.

I have also heard reports, including from a number of state banking regulators, that some recent supervisory actions are excessive in light of the risks posed by certain smaller institutions. These reports of increased scrutiny, including on community and smaller regional banks—banks that were not responsible for the banking stresses earlier this year—are concerning, as they could undermine the nature of joint supervision between state and federal supervisors under the dual banking system.

In light of today’s remarks it is also interesting to look back on a different speech Governor Bowman delivered at the start of October, in which she asked:

Are the federal banking agencies acting in a consistent manner in their bank supervisory activities? Are federal banking agencies coordinating appropriately with state banking agencies when reviewing state-chartered banks?

Taken together, the implication of these speeches seem to be that some state regulators (and pretty clearly also Governor Bowman) believe the answer to that last question to be no.

Are they right, or do the federal banking regulators have the better of the argument? As with a lot of questions related to bank supervision, the answer is, frustratingly, not entirely clear.

In typically maverick fashion, FRB Minneapolis President Neel Kashkari went with, “The banking system is resilient, and it’s sound.”

See page 2, for instance: “The banking sector remains sound and resilient overall, and most banks continued to report capital levels well above regulatory requirements. That said, the increase in interest rates over the past two years has contributed to declines in the fair value of longer-maturity, fixed-rate assets that, for some banks, were sizable.”

See also Governor Cook’s speech from earlier this week.

Defined for this purpose as Fed-supervised holding companies with $100 billion or more in total assets, plus large foreign banks with $100 billion or more in total U.S. assets, including in their U.S. branches.

I’ve modified the redline a little because some things were capitalized in one quarter and lowercase the other quarter, hyphenated one quarter and not the next, etc. such that they showed up as changes in the initial redline when they were not actually substantive changes. Any remaining capitalization or punctuation that looks wrong is probably my fault, not that of the authors of the report.

Again, note the caveat about the as-of date. This is maybe particularly relevant for smaller banks, which depending on the circumstances may be on a longer exam cycle.

As was done for the LFI supervisory priorities above, here is a comparison of the CBO and RBO supervisory priorities laid out in this report, compared to the equivalent priorities identified in the May 2023 iteration of this report.

So not much substantive change in the bulleted list, but the narrative discussion in the report maybe gives more of an indication as to where the areas of focus lie.

For instance: if, as the IG believes to be the case, the RBO supervisory program needs to better focus its efforts on “salient risks,” how confident can one be that the supervisory findings related to RBOs discussed in the report, and as highlighted in an earlier section of this post, are actually focused on salient risks?