Most U.S. financial services companies that are publicly traded will this month or in early March file their annual reports on Form 10-K. A few others not on a calendar fiscal year will file their quarterly reports on Form 10-Q. This post is the first in a series looking at year-over-year or quarter-over-quarter changes in some of the regulatory and other disclosures included therein.

To start with the typical disclaimer: this is just a collection of things I thought were interesting. The new disclosures discussed in this post may not be material. They may instead simply be the result of lawyers or others responsible for writing the disclosures having a bit more time on their hands as compared to last year, or otherwise feeling moved to do some wordsmithing.

Even acknowledging that significant caveat, I hope this series of posts will identify a few trends that are noteworthy.

Affirm

Affirm filed its 10-Q on February 8, the same day that it announced earnings.

Moving Away From Cross River Bank

In previous regulatory filings, Affirm had stated that it relied on Cross River Bank, a New Jersey state-chartered nonmember bank, and Celtic Bank, a Utah industrial bank, to originate a “substantial majority” of its loans.

This week’s 10-Q included an updated risk factor stating in relevant part that Affirm last month made the “strategic decision” to begin reducing the volume of loans originated by Cross River.

As of the end of the second quarter of fiscal 2023, we relied on Cross River Bank and Celtic Bank to originate a majority of the loans facilitated through our platform and to comply with various federal, state, and other laws, with the balance of the loans facilitated on our platform being originated directly under our lending, servicing, and brokering licenses in Canada and across various states in the United States through our consolidated subsidiaries. During the first half of fiscal 2023, we began accelerating the execution of an existing strategy of identifying and engaging new originating bank partners in order to diversify our sources of loan originations. In January 2023, we made the strategic decision to begin reducing the volume of loans originated by Cross River Bank on our platform while at the same time continuing our ongoing work to identify and engage new originating bank partners. Consequently, as of January 31, 2023, a majority of the loans facilitated through our platform are originated by Celtic Bank. As a result, the risks discussed in the paragraphs below relating to our reliance on Celtic Bank have increased and will remain as such unless and until we complete the process of engaging and onboarding one or more new originating bank partners. The process of engaging and onboarding new originating bank partners is inherently uncertain, and there can be no assurances as to when we will be able to complete that process, if at all.

It is not clear why this strategic decision was made, but here are a few reasonable possibilities (obviously not an exhaustive list):

Maximum Interest Rates. Yizhu Wang at S&P Global Market Intelligence highlighted Affirm’s increasing shift to making interest-bearing loans as opposed to its interest-free Pay in 4 offering. If, as management expects, that is going to continue to be the trend, then maybe Affirm prefers to partner with banks permitted to originate loans at higher APRs than what New Jersey law permits.

Upcoming Contract Expiration. Affirm’s loan program agreement with Cross River Bank is set to expire in November 2023.1 If the parties have not yet been able to agree commercially on an extension, and if Affirm has assessed that such an extension is unlikely, then perhaps Affirm decided to proactively begin winding down its relationship with Cross River Bank. (Note that the agreement with Celtic Bank also currently is set to terminate in 2023, so TBD on that.)

Cross River Decision. Consistent with the description in the 10-Q, the above suggestions assume that this was a strategic decision driven by Affirm. But of course Cross River Bank is subject to its own regulatory framework enforced by its New Jersey state regulator and by the FDIC. It is possible, then, that for whatever reason (credit risk considerations, regulatory scrutiny regarding fintech relationships, etc.), and regardless of how Affirm felt about the relationship, Cross River Bank had its own desires to reduce the volume of Affirm loans it was originating.

A Minor CFPB Update

I am not sure this even counts as news, but for what it is worth in this latest 10-Q Affirm updated one of its regulatory risk factors as shown below to state that it expects to engage further with the CFPB on BNPL issues.

American Express

American Express on Friday filed its 10-K.

Competition, Including From the Government

This addition to the risk factor regarding competition jumped out to me, though I have to admit I am not totally positive about the governmental entity to which this is referring. Is this maybe about FedNow and real time payments, or is that totally wrong and I am missing something else that is obvious?

Merchant Category Codes and Other Related Controversies

AXP’s risk factor regarding its brand and competition was updated to highlight risks that could arise from the ongoing debate around MCCs for gun sellers and other related controversies.

Climate Change

As is expected to be a trend this 10-K season, American Express includes a beefed up discussion of climate risk. Note the sentence at the end regarding the company’s risk management framework.

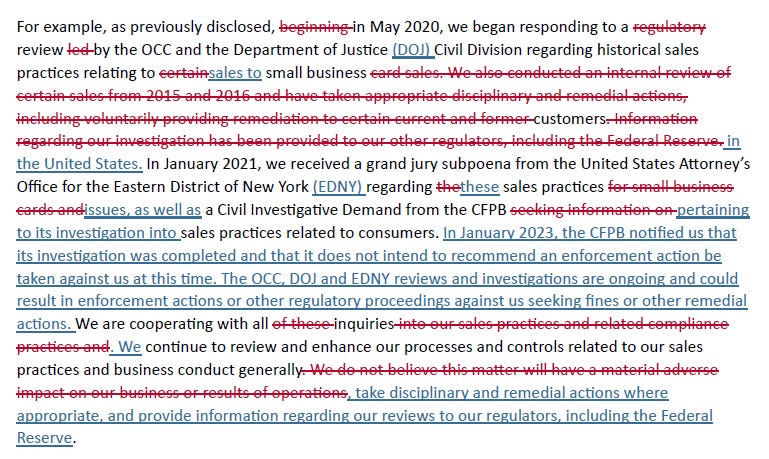

Sales Practices and Other Investigations

As spotted by Evan Weinberger at Bloomberg Law, American Express disclosed that the CFPB’s investigation into its sales practices has been completed without a recommendation of enforcement action. Investigations by other governmental authorities remain ongoing, however, and the company continues to provide information to the Federal Reserve Board.

Note also, for what it is worth, the change made in the paragraph following the above.

LendingClub

It has now been a little over two years since LendingClub became a bank holding company by acquiring Radius Bank. The company’s latest 10-K filed this week includes a few new or updated disclosures of note.

Brokered Deposits

Last week was a good week for discussion of deposits, including several articles from the American Banker2 examining the extent to which certain banks have benefited from recent FDIC changes to the definition of what counts as a brokered deposit.

In its 10-K LendingClub updated its We may not be able to maintain our deposit base risk factor to note that as of year-end 2022 it had approximately $6.4 billion in deposits, of which $1.2 billion were brokered and $5.2 billion were core deposits.

The company also, however, included new disclosure noting that many of its core deposits are sourced through third-party platforms. According to LendingClub, changes to the way those platforms operate, or to the way LendingClub interacts with such platforms, could affect the bank’s ability to retain or continue to grow these types of deposits.

ESG

In its risk factor relating to the need to maintain, protect and promote its brand, LendingClub included a new paragraph relating to ESG. Of note, the company states that both its platform investors (i.e., the people who buy the loans) and its equity investors have inquired about the company’s progress in addressing ESG-related issues.

Many of our stakeholders are becoming increasingly interested in our environmental, social, governance and other sustainability responsibilities, strategy and related disclosures. For example, certain of our platform investors and equity investors have recently inquired about our progress and disclosures on this topic. Further, this area of disclosure is subject to proposed rules from the SEC, which the Company continues to monitor and will comply with as applicable. Our absolute and relative progress and disclosures, or lack thereof, on environmental, social, governance and other sustainability matters could impact our reputation, brand and the willingness of certain platform and equity investors to hold our loans or common stock, respectively. If we do not successfully maintain, protect and promote our brand we may be unable to maintain and/or expand our base of customers and investors, which may materially harm our business.

AI and the Use of Models

The use of AI and other tools in credit modeling has been a continuing area of focus for state and federal financial regulators. For example, in May 2022 the CFPB announced that it was taking action to “protect the public from black-box credit models using complex algorithms.” An OCC official also last year outlined certain supervisory expectations related to the use of AI.

I think it is in that context that this new paragraph in AXP’s risk factor regarding credit decisioning, pricing and models should be understood.

Further, the use of these models, algorithms and artificial intelligence for determining loan grades and corresponding interest rates may also heighten the risk of legal or regulatory scrutiny. We may be required to alter our models for compliance purposes, which could impact the interest rates offered to borrowers, the risk-adjusted returns offered to investors, result in higher losses or otherwise impact our results of operations.

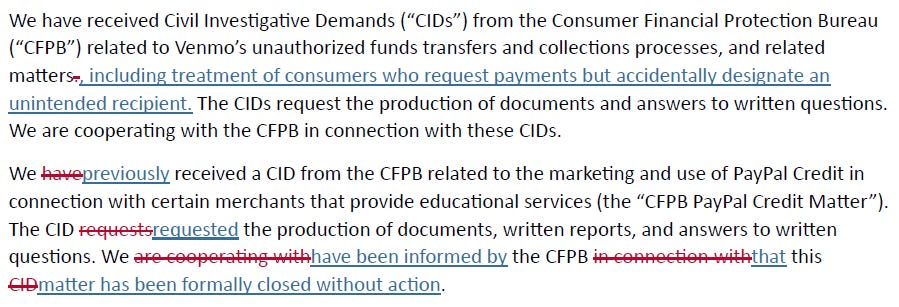

PayPal

Finally, this probably falls into the category of barely interesting (if that), but PayPal’s 10-K yesterday included the following updates on two CFPB investigations.

Thanks for reading! Thoughts, challenges, criticisms are always welcome at bankregblog@gmail.com.

The agreement may also be terminated earlier in certain circumstances; see Article VIII.

These include Kyle Campbell’s article on Silvergate, an article from Claire Williams looking at, among other things, the FDIC’s list of firms relying on the primary purpose exception, and a column from John Heltman.