Farmington State Bank is a small Washington state-chartered bank in which FTX-affiliate Alameda Research owns a slightly less than 10% stake. The bank recently filed a consolidated report of condition and income, otherwise known as a call report, setting out full-year 2022 results.

For the year, Farmington State Bank reported an annual loss of $5,300,000, compared to an annual loss of $808,000 in 2021, driven mainly by sharply increased non-interest expenses.

If this performance keeps up, Farmington’s investors may need to start marking down their assessment of the “technology and data first strategy” that drove the bank’s $115 million valuation.

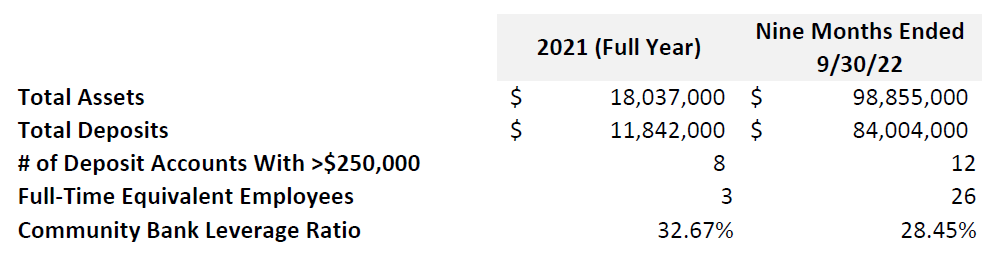

Joking aside, it remains pretty crazy to look at some of the line items reported by Moonstone at year-end 2021 (pre-Alameda investment) and compare it to where things had gotten by the end of September 2022.

Equally crazy, though, was the fourth quarter of 2022, in which the asset and deposit growth trend quickly reversed.

And of course many of the remaining deposits as of December 31, 2022 are now spoken for:

the Government respectfully gives notice that the property subject to forfeiture as a result of the offenses described in Counts One through Four and Seven of Indictment 22 Cr. 673 (LAK) against SAMUEL BANKMAN-FRIED, and as alleged in the forfeiture allegations and/or substitute asset provision therein, includes the following: […]

$49,999,500 in United States currency formerly on deposit in Account Number 9000-1924-02685 at Farmington State Bank d/b/a “Moonstone Bank” held in the name of “FTX Digital Markets” seized by the Government on or about January 4, 2023;

Ongoing Investigations

In a filing on January 25, FTX and the official committee of unsecured creditors jointly asked the bankruptcy judge overseeing FTX’s Chapter 11 proceedings to permit them to serve subpoenas with document requests on various former FTX insiders, including Sam Bankman-Fried, Gary Wang, and Caroline Ellison.

Among other questions, the proposed document requests to SBF, Wang, Ellison and other insiders include the following:

All Documents concerning any investments in or transactions with Moonstone Bank (previously known as Farmington State Bank) by or on behalf of You or any entity within the FTX Group.

Of course, FTX and its unsecured creditors are not the only ones with an interest in the Farmington State Bank investment. FDIC Chairman Gruenberg has said his agency and the Federal Reserve Board are “looking closely” at it.

It is tough to say with specificity what exactly has been happening on the investigation front, but I think we can infer that Farmington has been engaged with a number of governmental authorities.

For the year, the bank reported $6.7 million of non-interest expense, of which $962,000 was “legal fees and expenses” and a further $1,217,000 was for “consulting and advisory expenses.”1 These are full-year numbers, but unless I misunderstand how the call report instructions work, the vast majority of these were incurred in the fourth quarter of 2022 after FTX blew up.2

Farmington announced last week that it no longer wanted to be called Moonstone Bank and that it was “discontinuing its pursuit of an innovation-driven business model.” The pursuit of Farmington, though, looks set to continue.

Thanks for reading! I am always interested to hear any thoughts, challenges, criticisms, etc. If you are so inclined, you can email bankregblog@gmail.com.

The bulk of the remaining non-interest expense, $3.27 million, was spent on “salaries and employee benefits.”

A bank is required to itemize certain line items of other non-interest expense if such line items are “greater than $100,000” and “exceed 7%” of total other non-interest expense. For the nine months ended September 30, 2022, Farmington reported $1.8 million of total other non-interest expense, but did not itemize any expenses for legal fees or for consulting and advisory. Thus by my math spending on both of those must have been below $126,000 for the nine months ended September 30. If that is right, this would mean that legal spend in Q4 was around $800,000, and that Q4 consulting spend topped $1 million.