Further Developments at Vast Bank

With capital infusion pending, bank takes a significant impairment charge

Last November, this blog featured a short post about a consent order entered into in October 2023 by the Office of the Comptroller of the Currency and Vast Bank, a small national bank based in Tulsa, Oklahoma.

Though neither cryptocurrency nor digital assets were mentioned directly in the October 2023 consent order, the November blog post wondered whether, given Vast Bank’s previously announced crypto initiatives and provisions of the order relating to custody controls and risk management for new products, this might be what certain provisions of the order were about.

Vast Bank confirmed to local media a few days later that this was in fact the case.

CEO Tom Biolchini said federal regulators had concerns about the bank holding cryptocurrency assets for customers.

The bank started advertising crypto accounts in 2020, but the venture was small, less than 1% of holdings, according to Biolchini, who said currently Vast holds about $2 million of crypto assets, with no investment by the bank.

Biolchini went on to explain that Vast Bank planned to exit the crypto business.1

“Vast Bank has made the strategic decision to exit it. You have to separate crypto-currency from the community banking that is Vast Bank,” he said, emphasizing there will be no impact on customers outside of the few involved with cryptocurrencies.

Looking at Vast Bank’s call report filed yesterday,2 there was another part of the October 2023 consent order to which in hindsight the November blog post did not pay enough attention.

Intangible Assets

In a provision of the consent order headed Accurate Books and Records, the OCC directed Vast Bank to devise a plan to ensure that its books and records are maintained in accordance with GAAP, “including but not limited to ensuring all intangible assets are accounted for in accordance with GAAP and appropriate adjustments are made as required...”

According to the call report Vast Bank filed yesterday - the first due since entry of the October 2023 consent order - it looks like Vast Bank did in fact make a meaningful change to how it accounted for certain intangible assets.

Specifically, after not reporting anything for this line item in the first three quarters of 2023, Vast Bank in its fourth quarter call report reported a charge of $55,493,000 attributed to amortization expense and impairment losses for other intangible assets.

The fourth quarter call report does not include an explanation for this charge, but the $55,493,000 amount corresponds closely to $55,422,000 of “computer software”3 reported as “other assets” on the bank’s third quarter call report.

This computer software line item on the other assets schedule is now listed as “NR” on the bank’s fourth quarter call report.4

Overall Results

Overall for the year ended December 31, 2023, Vast Bank reported a net loss of more than $70 million, with around $66 million of that loss coming in the fourth quarter.

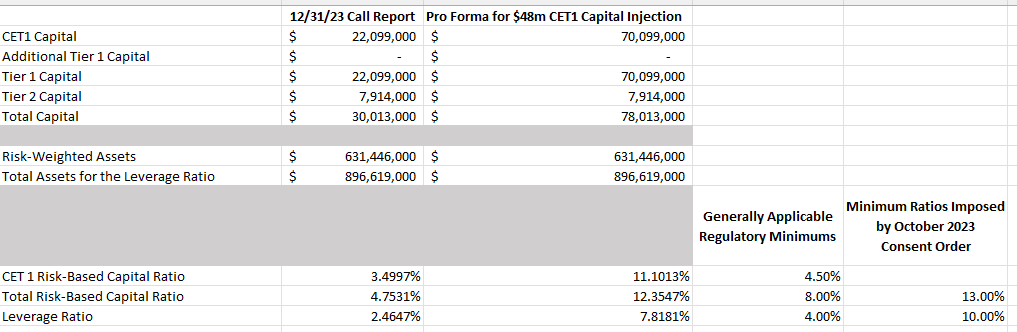

This loss significantly outweighed the $8.725 million in capital contributions made to Vast Bank by its parent company over the course of the year, and thus had severely negative implications for the bank’s capital ratios. In its fourth quarter call report, Vast Bank reports a leverage ratio of 2.5%5 and a CET1 capital ratio of 3.5%, each below regulatory minimums.

To be clear, though, as explained below this is point-in-time data as of the end of the fourth quarter of 2023. It does not necessarily reflect Vast Bank’s current (or near future) capital position.

Pending Capital Infusion

In November 2023, Vast Bank’s holding company announced that it had reached a deal for a capital injection from Greg Kidd. The law firm that advised Vast Bank and its holding company on the deal stated that the $48 million investment, subject to regulatory approval, was expected to close “in December 2023 or the first quarter of 2024.”

Assuming the transaction closes as scheduled,6 and assuming that all $48 million of that capital is injected by the holding company into Vast Bank as CET 1 capital, dumb pro forma back of the envelope math has Vast Bank’s capital ratios again exceeding regulatory minimums.

That’s not necessarily the end of the story, though, as in this case compliance with regulatory minimums is not enough. As part of the October 2023 consent order, the OCC imposed individual minimum capital requirements above generally applicable regulatory minimums, such that Vast Bank is now required to maintain a total capital ratio of at least 13% and a leverage ratio of at least 10%. It’s not clear whether the $48 million capital injection from Mr. Kidd, on its own, will fully get Vast Bank there,7 but it should get them fairly close.

See also this FAQ on Vast Bank’s website:

To strategically align our operations, effective Wednesday January 31st, 2024, we will be disabling and removing the Vast Crypto Mobile Banking application from Google and Apple, which means your Vast Crypto Mobile Banking account(s), including any Digital Assets held in custody, will be liquidated and closed.

This is available at cdr.ffiec.gov; Vast Bank’s RSSD ID is 347956.

The call report instructions describe computer software in the context of this schedule as capturing:

Purchased computer software, net of accumulated amortization, and unamortized costs of computer software to be sold, leased, or otherwise marketed capitalized in accordance with the provisions of ASC Subtopic 985-20, Software – Costs of Software to Be Sold, Leased or Marketed.

NR does not necessarily mean zero, it just means that the amount is not reported as it was not above the threshold at which itemization was required. But here the context strongly suggests the computer software in question, whatever it was, has now in fact been written down to zero.

The bank’s total assets fell from just over $1 billion at the end of the third quarter to around $755 million at the end of the fourth quarter. Because the denominator of the leverage ratio looks at average assets over the quarter, significant declines in total assets like this over the course of a single quarter can have the effect of making the leverage ratio look lower than it otherwise would be. But here even if you used Vast Bank’s fourth quarter ending total assets as the denominator for the leverage ratio, it would still be shy of the regulatory minimum.

The related regulatory application was submitted in mid-December 2023 and the comment period closed on January 20, 2024.