Fintech Founder Acquisitions of Small National Banks

A look at the early results for three banks purchased by individual fintech founders

In August 2018 Mark Moskvin and Maxim Yaroshewsky bought Colorado National Bank for just under $9 million dollars. In later press releases, the bank has taken the position that this made Colorado National Bank “the first U.S. national bank to be acquired by Fintech entrepreneurs.”

Since then, a few other fintech founders have followed the same path to obtaining a U.S. bank charter. Ahead of the release later this month of Q2 2022 call report data, this post looks at how things are going, first for Moskvin and Yaroshewsky, and then for two more recent entrants.

Colorado National Bank

A few weeks before Thanksgiving 2017, Colorado National Bancorp filed for bankruptcy:

The company had been considering its strategic options since 2015. The noteholders in December of that year suggested a reorganization / recapitalization, which the board rejected because of its breakup fee and execution risks. In January 2016, the board engaged the services of Atlantic Merchant Capital Advisors LLC to solicit offers. A number of the potential partners declined to participate due to regulatory uncertainty or the limitations on the bank's Small Business Administration lending capabilities. A few proposals were received, including one with a $3.0 million purchase price. The noteholders rejected that offer in April.

The purpose of the holding company’s bankruptcy filing was to help facilitate a sale of its equity interest in Colorado National Bank, and ultimately Mark Moskvin and Maxim Yaroshewsky, the entrepreneurs behind a Latvian payments processing fintech called Transact Pro, emerged as the winning bidders.1

Moskvin and Yaroshewsky pledged to use their knowledge and experience to help “build innovative new banking services for the bank that will transform it into a modern bank for the 21st century.” At the time of the acquisition it was reported that, in addition to the $9 million purchase price, Moskvin and Yaroshewsky contributed $2 million in additional capital to the bank.

The OCC approved the acquisition in July 20182 and the transaction closed in August 2018. The bank later announced in March 2020 that it would rebrand as Transact Bank, National Association and that, working with its parent company Transact Pro, “by means of card and account issuing APIs on both continents, the two companies intend to provide the first true platform to support direct domestic and cross-border local payment processing and card issuing.”

Regulatory Issues

The bankruptcy of its parent company was not the only issue facing Colorado National Bank at the time of the takeover. In August 2016, the OCC found that the bank had engaged in “certain unsafe and unsound banking practices relating to the Bank’s capital, Comprehensive Business Plan, corporate governance, credit administration, trust administration, and Bank Secrecy Act/Anti-Money Laundering compliance program,” and required the bank to enter into a written agreement.

Many of these preexisting regulatory issues have persisted post-acquisition. Most notably, in March 2021 the OCC brought another public enforcement action, this time resulting in the imposition of a cease and desist consent order. Among other things, the March 2021 order stated that the bank had not “attained full compliance” with the 2016 written agreement and that the bank’s capital and strategic planning, capital levels, and earnings performance remained deficient in light of the bank’s “complexity and risk profile.”

To address these deficiencies, the OCC required Transact Bank to develop a written Capital and Strategic Plan that would “establish objectives for the Bank’s overall risk profile, earnings performance, growth, balance sheet mix, off-balance sheet activities, liability structure, and capital and liquidity adequacy, together with strategies to achieve those objectives.” The OCC also required the bank to maintain capital levels above ordinary requirements.3

In addition, separate and apart from the OCC’s enforcement action against the bank, Transact Pro and Moskvin (in his capacity as former CEO of Transact Pro) in January 2020 settled charges with the U.S. Federal Trade Commission. The FTC’s complaint alleged, and in the settlement agreement Transact Pro and Moskvin neither admitted nor denied, that they had “engaged in unlawful conduct that enabled a deceptive ‘free trial’ offer scheme” by enabling the (unaffiliated) company operating the scheme to “maintain[] merchants accounts … in the name of shell companies” and to “evade credit card chargeback monitoring programs.” There were no allegations in the FTC’s complaint that Transact Bank played any role in the alleged conduct at issue.

Financial Issues

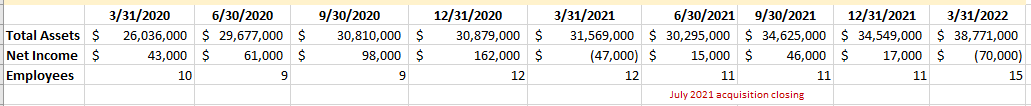

As the OCC’s 2021 consent order suggests, the post-takeover financial picture has also been fairly grim.4 The bank has struggled to generate income and has seen significant declines in total assets5 and in number of employees.

Public discussion of how Transact Bank is doing and how its owners are thinking about their next steps has been limited, but it is notable that since 2021 the bank has filed and subsequently withdrawn three applications to the OCC under 12 CFR 5.53 to undergo a substantial change in assets, most recently in March 2022.

First National Bank of Buhl

The First National Bank of Buhl (FNBOB) has operated in the Iron Range of Minnesota since 1905. In October 2021 in a blog post entitled “So… I bought a bank,” Brian Barnes, the founder and CEO of M1 Finance,6 announced that he had purchased FNBOB. Barnes explained that FNBOB would play a key role as an M1 partner bank as M1 sought to launch its next banking product and that, more broadly, he intended to “invest[] in the bank’s capabilities to become the premier banking as a service (BaaS) bank, primarily serving fintech clients such as M1.”

Like the other individuals discussed in this blog post, Barnes purchased his bank in an individual capacity, explaining that “M1 has work to do before it can be a bank holding company.”7

In the quarters since the acquisition closed in summer 2021,8 and consistent with a shift to higher-growth strategy,9 the bank has seen notable increases in total assets and in number of employees, albeit in both cases from a very low base. Net income turned negative in Q1 2022, but it is too early to draw any conclusions from this.

Aside from a few articles written around the time of the acquisition, FNBOB has generally stayed out of the national news, with the most recent mention a June 2022 Barron’s interview with Barnes in which he closed the interview by noting that he is “currently investing very heavily in the technology to support a digital banking infrastructure.”

Northern California National Bank

In March 2021, Plaid co-founder William Hockey and his wife Annie reached an agreement to purchase Northern California National Bank for around $50 million.

A Wall Street Journal article from this past April summed up the couple’s plan for the bank, which has now been renamed Column, National Association:10

[N]early every big fintech company has to rely on bank partners for regulated tasks such as holding customers’ deposits and issuing debit cards. Giants including JPMorgan Chase & Co. and Bank of America Corp. aren’t normally interested in that business. So even the flashiest app makers usually depend on community banks in faraway places to do their financial grunt work. Startups don’t love the current arrangement. Community banks tend to outsource their own technology to old-school software vendors, whose digital offerings are limited and whose fees are often high.

Column, as the Hockeys renamed NorCal, thinks it can solve that problem. The Column team developed its own banking platform from scratch, complete with a customized direct connection to the Federal Reserve’s payments network. It signed up clients, including the fintech companies Brex Inc. and Point Up Inc., letting them use Column’s software to automate the mechanics of activities such as opening bank accounts, moving money and extending loans.

As with FNBOB, it is too early to draw any firm conclusions about how things are going for Column since its acquisition,11 but like FNBOB Column has seen notable post-acquisition increases in total assets and employees, along with a Q1 2022 downturn in net income.

On Column’s website, the bank states that it is both profitable and 100% founder and employee owned. In a blog post, William Hockey explains that the company has chosen to fund itself with its own money and profits and that although this means the company may not grow as fast as possible, and that investors may go fund competitors instead, Column believes these tradeoffs are “more than worth it.”

No Conclusions

Between the COVID-19 pandemic, the rapid initial “boomflation” recovery, the broad tech downturn and the looming uncertainty of a potential recession, there are and will continue to be many confounding factors to sort through in determining to what extent the financial performance of the banks discussed in this post is attributable to the broader economy, the bank’s legacy operations, each bank’s (different) fintech-focused business model, or a combination of these factors. This post makes no attempt to do so.

Equally, from a regulatory perspective, I do not have a profound “what it all means for U.S. bank regulation of fintech” conclusion for this post. My own personal bias is that the current bank regulatory system, although not without areas for improvement, overall is working pretty well. Consistent with that general outlook, I do not think anything in this post suggests that a radical rethinking of approach to small national bank acquisitions by individual fintech founders is required. The OCC’s supervisory tools, so far, seem up to the task.

That does not mean there are not areas to watch. Just to quickly name two:

Over the weekend Jason Mikula’s Fintech Business Weekly reported, based on conversations with sources at banks, fintechs, BaaS platforms, VCs and regulators, that the U.S. banking regulators, and particularly the OCC, have “significantly stepped up scrutiny” of BaaS business models. In this context, Mikula also reported that Column has ceased onboarding new clients.

I would be interested in learning more about the OCC’s approach to monitoring banks’ relationships with affiliated companies controlled by their fintech founders, especially in cases where the affiliated company is not regulated as a bank holding company or a subsidiary thereof.

In any case, regardless of how things end for Transact Bank, FNBOB and Column, I expect small national banks to continue to serve as intriguing acquisition targets, not only for fintech founders like those discussed in this post but also for fintechs themselves.12

A Transact Pro press release at the time stated that Moskvin would hold a majority stake, while his business partner Yaroshewsky would hold a minority stake.

OCC approval was required under the Change in Bank Control Act because the two founders were acquiring the bank in their individual capacities, without the use of a holding company. As a result, no Federal Reserve Board approval was required under the Bank Holding Company Act.

See Article IV of the consent order, which (i) imposes a 10% Tier 1 capital to adjusted total assets requirement, (ii) imposes a total risk-based capital requirement of 12% and (iii) in addition to ratios required by (i) and (ii), requires the bank’s Tier 1 capital to be no less than $7.2 million. Note that, based on a review of call report data since the entry of the 2021 consent order, Transact Bank has never achieved this third requirement.

All the banks referenced in this blog post are privately held. The financial data comes from publicly available call reports.

The sharp leg down in total assets and employees in 2019 is likely attributable to the bank’s sale of one of its branches, but even looking at things only from that point onward, the reduction from then until today is significant.

M1 is a fintech platform that “helps people manage and grow their money with control and automation, empowering hundreds of thousands of self-directed investors to open accounts and improve their financial well-being through investing, digital checking and portfolio lines of credit.” In July 2021, the company closed a Series E funding round valuing it at $1.45 billion.

Following the OCC’s approval of Barnes’s acquisition of the bank and the closing of the acquisition, a company called B2 Holding Company, Inc. filed a notice with the Federal Reserve Board “in connection with the Company's formation as a bank holding company through the acquisition of 100% of the voting stock of The First National Bank of Buhl, a national bank with its main office located in Mountain Iron, Minnesota (the Bank).”

Based on Barnes’s public statements and the provision of Regulation Y under which this notice was filed, this suggests that Barnes continues to own the bank in his individual capacity, but through a (non-M1) holding company he controls, rather than owning the bank directly.

The OCC’s applications tracking tool states that the transaction was consummated July 30, 2021. I am therefore using that as the closing date for the acquisition, even though the public announcement by Barnes did not come until a few months later.

Shortly after the acquisition closed, the OCC approved an application by FNBOB under 12 CFR 5.53 “to change the composition of all, or substantially all, its assets through an expansion of its operations.” The OCC explained that, as part of the expansion of operations, the bank intended to “partner with an affiliated securities company to expand its market nationwide using the Internet as a distribution channel.”

The retail-facing, Chico, California-based operations of the bank continue to operate under the name Northern California National Bank, as this FAQ for customers explains.

The OCC’s applications tracking tool shows the Change in Bank Control Act application was filed in March 2021 and approved by the OCC in June 2021, but does not list a consummation date for the transaction. The WSJ article linked above explains that the deal did not close immediately after receiving OCC approval because the Hockeys “needed shareholders to tender at least two-thirds of their paper stock certificates. Records were incomplete, and several shareholders lost their certificates in the 2018 Camp Fire that burned more than 100,000 acres of Northern California.”

This post focused on acquisitions by individual founders, but in addition to relatively well-known SoFi acquisition of Golden Pacific Bank, noteworthy acquisitions in the category of acquisitions by fintechs themselves include Jiko Group’s 2020 acquisition of Mid-Central National Bank and Versabank’s pending acquisition of Stearns Bank Holdingford. This latter acquisition is particularly interesting in that Versabank is already a fully chartered Canadian bank and this acquisition will serve as its means of obtaining a U.S. bank charter.