This evening the FDIC announced that Citizens Bank,1 a $66 million asset nonmember bank based in Sac City, Iowa, had failed. As is standard, the FDIC’s announcement was fairly terse, announcing that all deposits had been assumed by Iowa Trust & Savings Bank2 and that the estimated loss to the DIF is expected to be $14.8 million, without going into the reasons for the failure.

I cannot claim to know the full story, but I think it is possible based on public information to piece together at least a few more details.

Bad Loans to an Unspecified Industry

Like the FDIC, the Superintendent of the Iowa Division of Banking also issued a statement tonight. The statement says that in the course of a joint FDIC/IDOB examination “examiners identified significant loan losses that had not previously been identified by the bank.”

The Superintendent’s statement goes on to say that the bank’s loan portfolio was concentrated in “out-of-territory and out-of-state loans to one industry” and that some of those loans had “incurred heavy losses.” The industry in question was not identified.

August 2023 Enforcement Action

I am not sure anyone outside of Iowa noticed this at the time (I didn’t), but in early August of this year the FDIC and IDOB entered into a consent order with Citizens Bank, Sac City, Iowa.

The first undertaking in the consent order required the bank to engage an “independent third-party loan consultant” with requisite knowledge, skills, ability and workout experience. The consent order went on to call out one loan portfolio in particular where this consultant was to put his or her expertise to use.

The Consultant will have full authority and discretion to administer and service the Bank’s commercial trucking loan portfolio, including the development of the Credit Risk Reduction Plan identified below.

The bank was also ordered to, among other things, establish “a cushion of highly liquid assets equal to at least 10 percent of total assets,” identify “established contingency funding sources,” and maintain leverage and risk-based capital ratios well above regulatory minimums.3

Call Report Data

Call report data for Citizens Bank, Sac City, Iowa, is consistent with the story suggested by the above.4

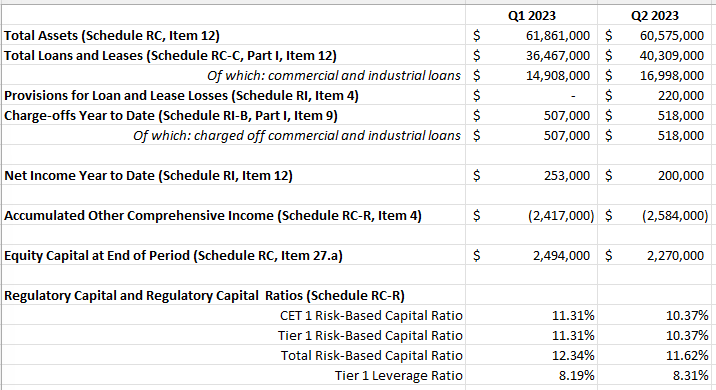

This was a small bank that focused a good portion of its lending on commercial and industrial loans. Through the second quarter of this year, that worked out … well, it wasn’t exactly great5 (look at that pile of unrealized losses6) but the bank could at least hope it might be able to muddle through.

Citizens Bank, Sac City, Iowa, Selected Call Report Data Q1 and Q2 20237

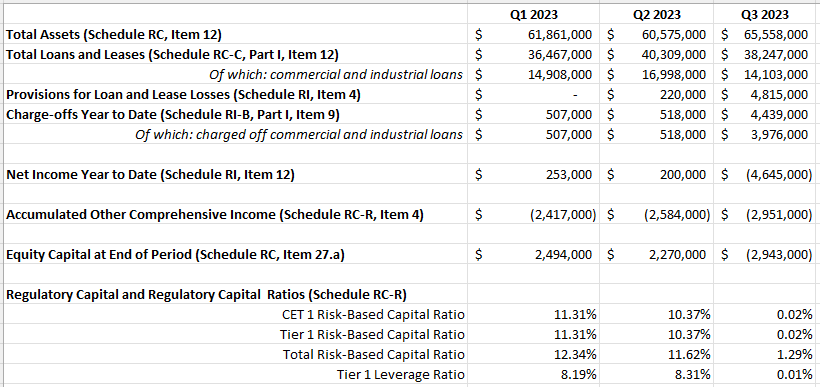

As the IDOB statement tonight and the August 2023 enforcement action suggest, however, at some point it became clear that there were issues with the bank’s loan portfolio that the bank had, for whatever reason, not identified. And, as the Superintendent says, some of these loans incurred heavy losses. Those losses start to show up in the Q3 call report data, as you can see below.

Citizens Bank, Sac City, Iowa, Selected Call Report Data for 2023

***

When Heartland Tri-State Bank failed earlier this year, some people who should have known better suggested it was evidence of a deepening banking crisis. That was pretty obviously a silly take right from the start, and subsequent reporting confirmed that the facts leading to that bank’s demise were (one hopes!) idiosyncratic indeed.

In the case of this small bank from Sac City, Iowa, the reasons for the failure appear to be at least a little closer to the reasons you might expect to see in a “normal” bank failure, but in this case, too, I think the more prudent move is not to draw any adverse conclusions about the state of the U.S. banking system as a whole.

A search through a database of bank call reports filed to date for the most recent quarter suggests that there are some 155 banks with Citizens in their name, thirteen of which, like this Iowa bank, are simply called Citizens Bank.

Funnily enough in light of footnote 1, there is both an Iowa Trust and Savings Bank and, separately, an Iowa Trust & Savings Bank (note the ampersand). The failed bank was sold to the latter.

As is standard for these sorts of orders, the bank was also ordered to take certain actions (which could include coming up with a plan to sell itself) if it wasn’t able to meet these ratios.

Should any capital ratio drop below the minimum required by subparagraph (a), the Bank must immediately notify the Supervisory Authorities and within 30 days:

(i) increase capital in an amount sufficient to comply with subparagraph (a); or

(ii) submit a written plan to the Supervisory Authorities, describing the primary means and timing by which the Bank will increase its capital ratios up to or in excess of the minimum requirements of subparagraph (a), as well as a contingency plan, including the possible sale or merger of the Bank, in the event the primary sources of capital are not available (Capital Plan).

The data in this section of the post is available here. As a reader pointed out recently, it is probably easiest to search by RSSD ID. For Citizens Bank, Sac City, Iowa, that is: 410944.

This S&P Global Market Intelligence story from May identified Citizens Bank, Sac City, Iowa, as a bank with one of the highest Texas ratios in the country, if you took the impact of AOCI into account.

Like almost all banks that are permitted to do so, Citizens Bank made an AOCI opt-out election so these losses did not flow through to regulatory capital.

This data comes from the most recently available Q1 and Q2 call reports for the bank, which were due 30 days after the end of Q1 and Q2, respectively. Note, however, that in mid-September Citizens Bank updated its call reports for Q1 and Q2, and the numbers shown here come from those subsequently updated reports, not the reports as originally filed.