FDIC Finalizes Special Assessment

A little more expensive than the proposal, but otherwise essentially unchanged

The FDIC today finalized its special assessment intended to recover the cost associated with protecting uninsured depositors in connection with the failures of Silicon Valley Bank and Signature Bank. It did so on the basis of a notational vote after abruptly cancelling the board of directors meeting it had previously scheduled for this morning.

Here are five quick takeaways based on things I highlighted when reading through the preamble and the final rule for the first time.

1. Consistent With the Proposal, Banks With Less Than $5 Billion of Uninsured Deposits Will be Exempt

As proposed, the assessment base for the special assessment would have been a bank’s uninsured deposits, as reported on its call report, but excluding the first $5 billion of uninsured deposits at the banking organization level. This definition of the assessment base has been adopted as proposed.

2. Compared to the Proposal, the Special Assessment Will be a Little More Expensive for Banks Subject to It

At the time of the proposal, the FDIC estimated that the loss it would need to recoup through this special assessment was $15.8 billion. Now, the FDIC estimates that the estimated loss is $500 million higher, at $16.3 billion.

This increase in estimated loss amount, combined with a lower total assessment base following revisions made by banks to their uninsured deposit amounts (see below), mean that the FDIC now will impose the special assessment at an annual rate of approximately 13.4 basis points, as compared to 12.5 basis points in the proposal. On a quarterly basis, the FDIC says this works out to quarterly rate of 3.36 basis points, compared to 3.13 under the proposal.

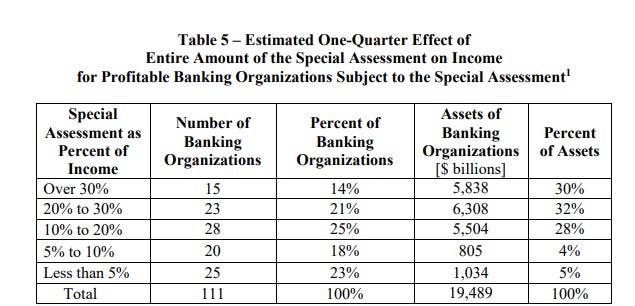

In the capital and earnings analysis section of the preamble to the final rule, the FDIC estimates that the special assessment will result, on average, in a one-quarter reduction in income of 20.4% for banks subject to the special assessment (compared to 17.5% as estimated in the proposal).1

3. The FDIC Declined to Adopt Any of Commenters’ Proposed Exclusions to the Assessment Base

As discussed previously on this blog, many commenters on the proposed rule argued that not all uninsured deposits are the same, and that therefore some kinds of uninsured deposits should excluded entirely, or at least treated differently, when calculating a bank’s total uninsured deposits for purposes of the special assessment.

The FDIC says it was not convinced by any of these arguments. It specifically addressed three of them.

Public and Other Collateralized Deposits

The FDIC notes that the only type of collateralized deposits specifically reported by institutions on their call reports are public or preferred deposits (i.e., collateralized deposits of states and other political subdivisions). The FDIC believes it would be unfair to give preferential treatment to those deposits, compared to other collateralized deposits, “on the sole basis that these are the only type of collateralized deposits for which data were collected.”

The FDIC also argues that, more fundamentally, “the presence of collateral does not fully mitigate run risk.” And, in some cases, collateralized deposits may actually result in higher losses to the DIF.2

Custody Bank Deposits and Operational Deposits

The FDIC believes that all large banks and all banks holding greater amounts of uninsured deposits benefited from the systemic risk determination, “regardless of the assets that those deposits were used to fund.” Therefore the FDIC does not see a justification for adjustments that “would result in custody banks paying significantly lower amounts of the special assessment despite holding significant amounts of uninsured deposits.”

With respect to operational deposits in particular, the FDIC acknowledges that such deposits “may be more stable than non-operational funding” but argues that nonetheless “in the event of idiosyncratic stress, counterparties likely would reduce the amount of their operational deposits.”3

Intercompany Deposits

The FDIC sees “no clear evidence that intercompany deposits are more stable relative to other deposits.” Instead, the agency believes the stability (or lack thereof) of intercompany deposits depend on a number of factors. The FDIC also makes a practical objection: “it is not possible to accurately estimate the portion of uninsured deposits that are intercompany deposits using existing items on the Call Report.”

The FDIC concludes this section of the preamble with the more general observation that the money for the special assessment has to come from somewhere, and therefore it is not willing to give favorable treatment to one category of uninsured deposits compared to another.4

4. Consistent With the Proposal, December 31, 2022 Will be the Reporting Date for the Assessment Base, But…

As proposed, the FDIC would have used call reports filed by banks for the quarter ended December 31, 2022 as the basis for calculating each bank’s assessment base. In response to this aspect of the proposal, a few banks argued that a later date would give a better picture of which banks really benefited from the systemic risk determination, and would prevent banks from being charged for uninsured deposits they no longer held after the stresses of March 2023 (or thereafter).

The FDIC disagrees and, as proposed, will use December 31, 2022 as the measurement date. The agency explains that it believes uninsured deposits as of this date “most closely approximate an institution’s vulnerability to significant deposit withdrawals in the absence of the determination of systemic risk, and therefore reflect the institutions that most benefited from such determination.”

There is a very important caveat to this, however.

5. … The FDIC Will Conduct an “Assessment Reporting Review” to Make Sure Banks Have Reported Their Uninsured Deposits Correctly

As has been publicly reported, there were an unusually elevated number of revisions to banks’ December 31, 2022 call reports, many of which resulted in reductions, and sometimes sharp reductions, in the amounts banks reported as uninsured deposits.

Not all of these revisions were improper, but the FDIC believed that some were inappropriate in light of the call report instructions. The agency therefore in July issued a Financial Institution Letter reiterating its expectations for how uninsured deposits should be reported. The FIL also pointedly reminded banks that the “chief financial officer … and multiple directors of each IDI are required to attest to the correctness of the Call Report.”

In today’s final rule, the FDIC says that the accurate reporting of amounts of uninsured deposits, as with all other items on the call report, is of “utmost importance.” Therefore:

The FDIC is conducting a review (Assessment Reporting Review) of the reporting methodology for estimated uninsured deposits and related items on the Call Report because of the importance of these items as indicators of safety and soundness.

The Assessment Reporting Review may result in amendments to uninsured deposits and related items reported on the Call Report if the FDIC determines that an institution is not reporting these items in accordance with the instructions.

Mechanically, based on what the FDIC says in the preamble and how I read the final rule, I think the way this will work is as follows.5

As a general rule, each bank’s assessment base will be based on uninsured deposits reported by the bank for the quarter ended December 31, 2022, taking into account any amendments appropriately made to that reporting by November 2, 2023.6

If the FDIC finds through its Assessment Reporting Review that a bank has been incorrectly reporting its uninsured deposits, the FDIC may require the bank to file a corrective amendment. The FDIC will then adjust the assessment base for that bank for all collection periods.7

If this adjustment results in a bank needing to pay more than originally assessed (because it initially reported an amount of insured deposits that was lower than the corrected amount), the retroactive amount of the assessment “will be included, in full, on the invoice for the quarter following the date of the amendment.”

If the adjustment results in a conclusion that the bank was overcharged (because it initially reported more uninsured deposits than it reports on its corrected call report), the FDIC will credit the overpayment amount, with interest, against any remaining amounts due from the bank in the quarter following the date of the amendment.

***

The vote on the final rule for the special assessment, as with the proposed rule, was three to two, with Vice Chair Hill and Director McKernan voting against. As of this writing, there have not been statements issued on the final vote from Hill, McKernan, or any other member of the FDIC board.

Elsewhere in uninsured deposits

Finally just briefly, a note that early this morning FDIC Chair Gruenberg participated in a panel at the seventh annual conference of the European Systemic Risk Board. During the panel discussion, Chair Gruenberg commented:8

On the relationship between long-term debt and uninsured deposits, I very much agree with [fellow panelist] Steve [Cecchetti], we don’t want more uninsured deposits, we want less uninsured deposits, quite frankly, in terms of concentrations. I think we are going to be looking to address that as a supervisory matter. And also I think the expectation is — assuming we move forward on a long-term debt rule in the regional bank space — long-term debt will take the place of some of the uninsured deposits on the balance sheets of these institutions, which would have multiple benefits.

Thanks for reading! Thoughts on this post or any other post are welcome at bankregblog@gmail.com

The FDIC says:

Further, in certain types of resolutions, collateralized deposits reduce the assets available to the FDIC as receiver to satisfy claims, including the FDIC’s subrogated claim as deposit insurer, and result in a higher loss to the DIF in the event of a bank failure compared to a bank holding the same level of deposits that are not collateralized.

Here the FDIC cites to the discussion of operational deposits in the preamble to LCR final rule from 2014. At least I think that was the goal; the FDIC’s footnote here just says “See 79 FR at 61502 (Oct. 10, 2014).”

The FDIC again:

Any revisions to the methodology for calculating the special assessment base, such as excluding or adjusting for certain types of uninsured deposits, would change the allocation of the special assessment, but the FDIC is required by statute to recover the full amount of the losses to the DIF incurred as the result of the systemic risk determination.

As a result, any exclusion for a type of uninsured deposits from the special assessment base would reduce the amount of the special assessment for banking organizations that hold those excluded, uninsured deposits, and increase the assessment burden for all other banks holding other types of uninsured deposits. For this reason, and for the reasons described above, and consistent with the proposal, the FDIC is not excluding any particular type of uninsured deposits from the assessment base for the special assessment.

This ignores any complications introduced by a situation where a firm maintains more than one IDI subsidiary.

The FDIC explains this date as follows: “As proposed, the assessment base and rate would be calculated as of the date the final rule is adopted; however, under the final rule, this is calculated on November 2, 2023, shortly before the date of adoption, for operational and administrative reasons.”

The FDIC also leaves open the possibility that a bank may on its own, not as a result of the Assessment Reporting Review, make amendments to its call report to correct its uninsured deposits as of December 31, 2022.

If the FDIC concludes that such an update “brings the reporting of uninsured deposits into compliance with the Call Report instructions,” the agency will then adjust the assessment base for that bank for all collection periods, in the same way as described in the text above.

Video of the entire conference used to be available at this link, but it looks like the video has now been taken down. (Sort of weird because it was an official ECB video). In any case, if the video is ever put back up, the comments quoted below came as part of remarks from Chair Gruenberg roughly 1 hour and 52 minutes in.

Update as of November 26, 2023: the ECB has now uploaded a standalone video of the panel. The quoted remarks from Chair Gruenberg come at the 1 hour 39 minute mark.